Thinking to start your business in Kosovo? The process is straightforward when your file is clean and sequenced correctly: choose the right structure, prepare the exact documents the registry and banks accept, and submit once without “please resubmit” emails. This guide walks you through the high-level steps foreign founders actually follow in 2025, the common pitfalls to avoid, and where our team steps in so you can launch on a fixed timeline.

Initial limited liability Company (LLC) registration requirements:

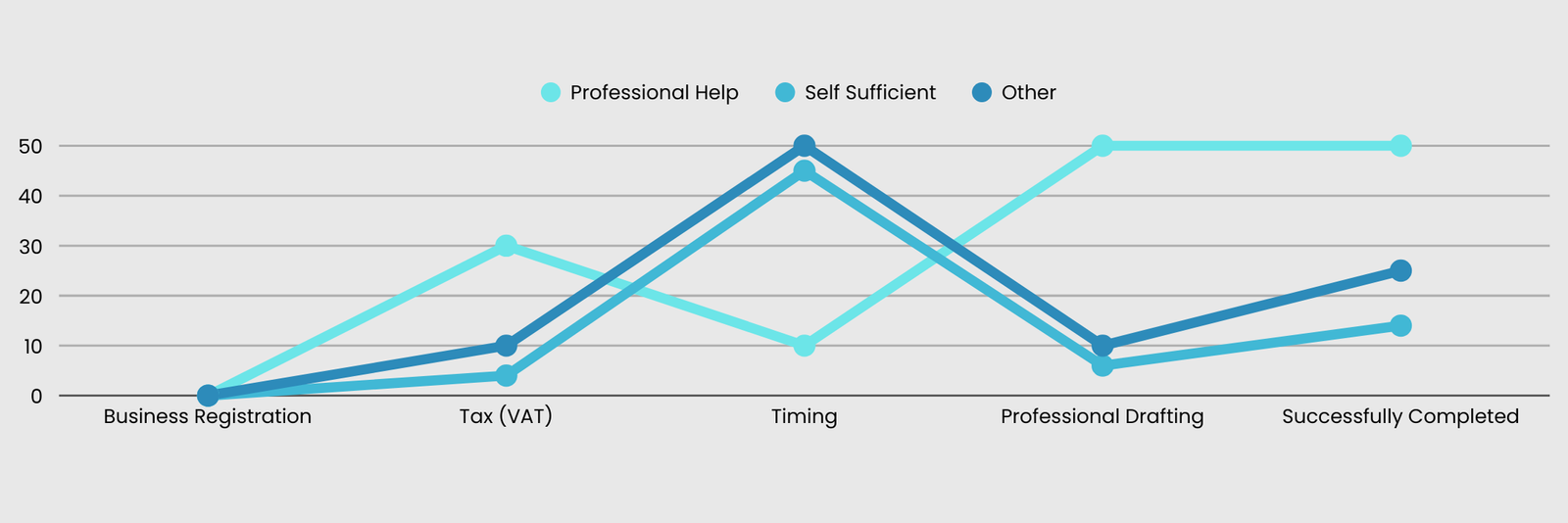

The above mentioned documents are services provided by our lawyers in Kosovo. The whole procedure is taken care of our lawyers in continuous contact with the business owner. Not only the business registration, but the bank account, Fiscal number registration, VAT registration (if requested or required), and accounting services for first three months of your business endeavour.

The standard VAT rate is 18%; a reduced 8% applies to specific supplies. Kosovo uses a 30,000 EUR turnover threshold for mandatory registration (voluntary registration remains an option depending on your client mix). We’ll time VAT to your model and configure compliant invoicing.

Pitfalls we see:

Registering too early or too late for the client base.

Invoices that miss mandatory fields, requiring re-issue.

Before anyone starts work, employers must handle day-before notifications and payroll setup. Mandatory pension contributions total 10% (5% employee + 5% employer). We provide compliant contracts and set up payroll calendars so there are no missed filings.

What this means in practice: you can onboard your first employee the right way in the same week your account goes live.

Pitfalls we see:

“We’ll file after they start” (leads to penalties).

Contracts missing clauses labor inspectors expect to see.

Most SMEs choose LLC (sh.p.k.) for flexibility; JSC fits larger funding/board needs. Both are governed by the Business Organizations Law (here).

10% CIT; small taxpayers may fall into gross-receipts taxation. Our Lawyers & accountants in Kosovo will map the right regime at kickoff.

18% standard and 8% reduced for specific supplies; registration rules apply (30,000 EUR threshold for mandatory registration). (VAT)

Disclaimer: This article is for information only and is not legal advice. For professional assistance with company registration in Kosovo, art@ruleandlaw.com.