How to Register a Business in Kosovo

Thinking about setting up a company in Kosovo? You want to know what to file, where to file it, how long it takes, and the taxes you’ll actually face. This works whether you’re a local founder or a foreign investor opening a company in Kosovo.

Note: registration is handled by the Kosovo Business Registration Agency (ARBK)

We handle the entire registration (See here): documents, filings, tax/VAT, banking letters, and first-hire compliance, so you don’t lose days learning acronyms.

Table of Contents

Pick your legal form (Why most founders choose an LLC)

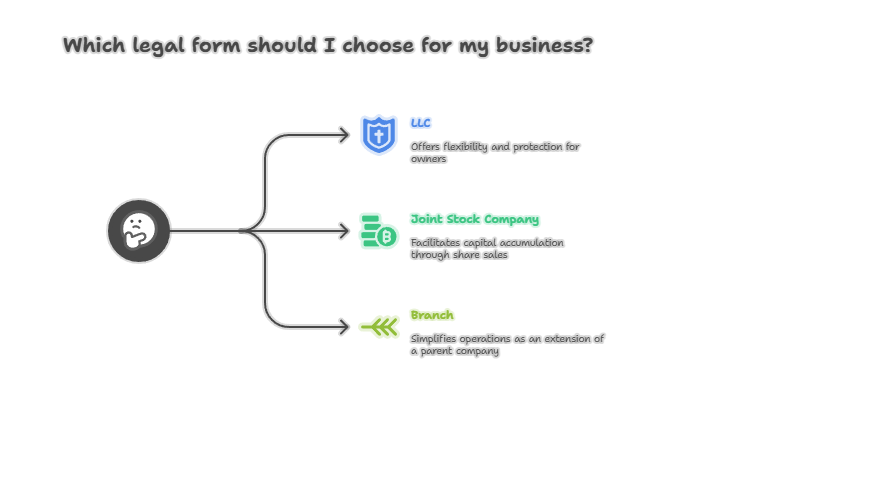

Before we dive in explaining How to Register a business in Kosovo, you must know that Kosovo’s company law offers several forms:

Individual Business (sole prop), General/Limited Partnership, LLC (sh.p.k.), Joint-Stock Company (sh.a.), plus branch/representative office for foreign companies. The framework is set by Law No. 06/L-016 on Business Organizations (Find Here):

- LLC (SH.P.K) – flexible, limited liability, no statutory minimum capital. Great for startups, agencies, consultancies, and SMEs.

- Joint Stock Company (JSC – SH.A.) – used for larger operations and fundraising; €10,000 minimum capital.

- Branch/Rep Office – keep the parent company abroad and operate in Kosovo through a branch/rep office; registered with ARBK.

1) What actually happens

Below are the high-level steps so you understand the path and the complexity. If you want us to run it, we’ll do everything including drafting the right clauses for your situation.

Most small and mid-size founders choose an LLC (sh.p.k.) because it’s flexible and protects personal assets. JSC (sh.a.) fits larger fundraising and board governance. Foreign companies can register a branch or rep office if they don’t want a separate entity.

Why this is tricky:

Tax exposure, liability, board/manager structure, and even future exits depend on what you choose today.

If you’re a foreign founder, your home-country documents may need legalization and an exact naming convention.

What we do: We map your model (services vs product, headcount, investors, forecast turnover) → recommend the structure → draft a charter that avoids amendment costs later.

2) Your name & business scope

A clear scope and the right NACE code are core to how to register a business in Kosovo without re-filing. You need a compliant company name and a clear activity scope tied to the right code.

Where people slip:

Names that are too similar to existing companies, or missing the required suffix (e.g., sh.p.k.).

Scopes written so narrowly you must amend at the first new client.

Missing Albanian translations where required.

What we do: Pre-check names, write a future-proof scope, and prepare bilingual documents.

3) Prepare the file

A typical LLC package includes: a founding decision/charter, IDs/passports of owners and the legal representative, registered address evidence, plus any LoA (Letter of Authorization) for us to file on your behalf. Foreign documents need notarization (rarely apostille) and sworn translation.

Where people slip:

Inconsistent passport spellings, middle names, or address formatting → instant rejection.

Proof of address that doesn’t meet the registry’s standard (or wrong dates).

Missing clauses in the charter (transfer restrictions, manager powers, deadlocks).

What we do: We draft the charter, collect the exact formats the registry and banks accept, and handle translations/notarization.

Most rejected files started with missing translations or inconsistent IDs, two silent blockers in how to register a business in Kosovo..

4) After approval: numbers, VAT, and the tax path

Once approved, you’ll receive your business certificate and a unique business number.

Now decisions matter:

VAT: Register immediately (common for B2B) or only when you hit the legal threshold (often €30,000 annual turnover, subject to change). The choice affects pricing and cash flow.

Corporate tax vs gross-receipts regime: Where you land depends on your turnover level and model.

Invoicing & accounting: If you don’t set it up right now, you’ll hate yourself at year-end.

What we do: We advise on when to register for VAT (here), set the tax path with your accountant, and configure compliant invoicing from day one.

5) Banking, KYC, and beneficial ownership

Opening the company bank account is important, especially if you want to functionalize the company as soon as possible. Most people are not careful enough with incomplete ownership charts, beneficial owner statements that don’t match the charter, wrong signature specimen, wrong contact details and other relevant procedural steps.

What we do: We prep the bank pack (charter, registry certificate, proofs) and stay on the call with you if compliance has questions

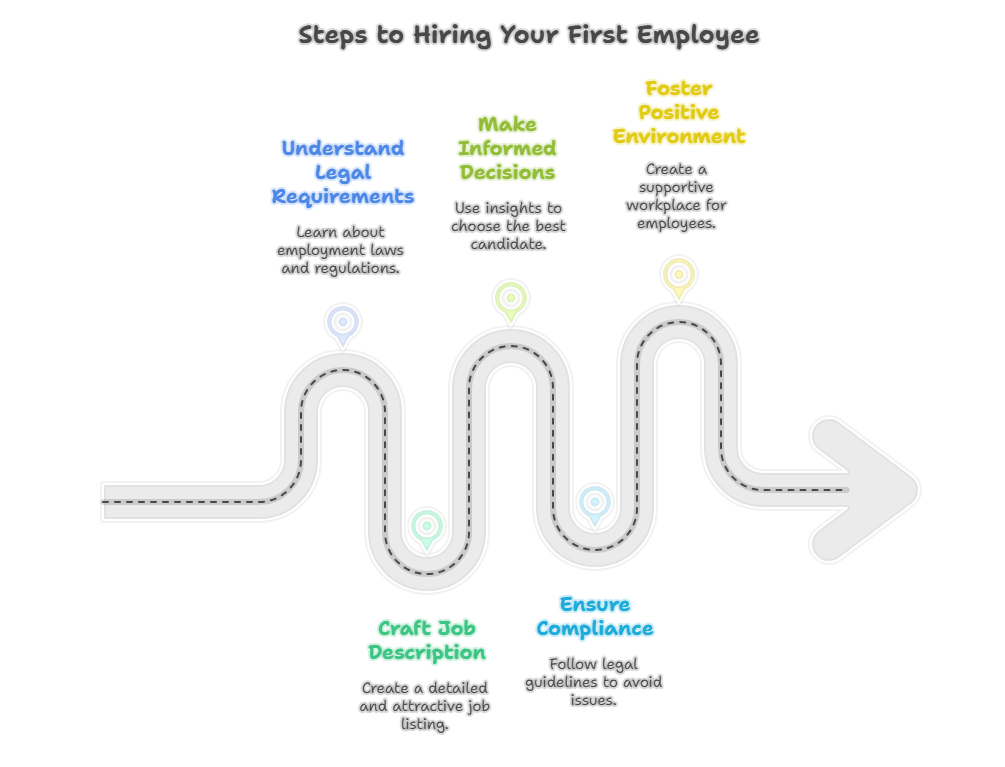

6) Hiring your first employee

Before anyone starts work, you must notify the Tax Administration using the proper form/system. You’ll also need payroll withholding and mandatory pension setup.

Where people slip:

“We’ll do it after they start.” That can equal fines.

Contracts missing the clauses Kosovo labor inspectors look for.

Whereas we file the notice on time, deliver compliant contracts, and set the payroll + pension contributions correctly.

What you get if we Register the Business in Kosovo for you:

- Entity formed (LLC/JSC/branch) with a future-proof charter

Certificate & number, bank pack, and guidance on the best bank for your profile

VAT decision & registration (if chosen)

Hiring starter kit: labor contract templates, payroll/pension checklist, day-before notice filed

1 month of support for any registry/bank questions after go-live

- 3 months of accounting services

FAQs

Do I need to travel to Kosovo to register?

Not usually. With a properly drafted Letter of Authorization, we can file and pick up everything for you. Some banks still prefer a quick in-person ID check, we’ll tell you which ones.

Is an LLC (SH.P.K.) always best?

For most SMEs, yes. If you’re planning external investment, a JSC (SH.A.) or a specific LLC governance design may be smarter. Details matter a lot therefore, we’ll map this to your plan.

How fast can I start issuing invoices?

Once the certificate and number are issued and your bank is active. If VAT applies (or you choose early VAT), we’ll time your first invoice to avoid re-issuing. This makes the procedure easier for you.

How much does it cost?

There are no government fees; real costs are legal drafting, translations and notaries, and professional handling. Our basic package and premium package differ, but we quote up front.

Disclaimer: This article is for information only and is not legal advice. For professional assistance with company registration in Kosovo, art@ruleandlaw.com.