Kosovo Exporters 2025 – CEFTA, SAA, Rules of Origin & EUR.1

Kosovo-based companies enjoy preferential trade opportunities that can significantly reduce costs and expand their market reach. By leveraging trade agreements like CEFTA and the EU’s Stabilisation and Association Agreement (SAA), Kosovo exporters can access regional and European markets duty-free for qualifying goods and services. However, taking full advantage of these regimes requires understanding the rules of origin and obtaining the proper certifications (such as the EUR.1 certificate). This article explains how foreign investors and business owners can benefit from Kosovo’s preferential trade arrangements, outlines the treatment of goods and services under these agreements, and details the legal framework for certifying exports. In doing so, we highlight Kosovo’s strategic geographic and legal position – and how Rule & Law can assist exporters in navigating compliance, certification, and cross-border trade setup.

Preferential Trade Opportunities for Kosovo Exporters under CEFTA & SAA

Kosovo is integrated into multiple free trade frameworks that eliminate tariffs and foster a larger market for its products and services. The two cornerstone agreements are:

CEFTA (Central European Free Trade Agreement) – a regional FTA among the Western Balkans. Kosovo has been a CEFTA member since 2007 (initially via UNMIK) and trades tariff-free with Albania, Bosnia and Herzegovina, North Macedonia, Montenegro, Serbia, and Moldova. CEFTA aimed to establish a full free trade zone by 2010, resulting in zero customs duties on almost all goods traded among members. Notably, as of late 2024 Kosovo is directly represented in CEFTA (no longer through UNMIK), marking a new era of equal participation. In 2025 Kosovo even holds the CEFTA Chairmanship, reflecting its active role in regional economic integration.

SAA with the European Union – a Stabilisation and Association Agreement that functions as a de facto free trade agreement with the EU. In force since April 2016, the SAA has been gradually phasing out tariffs between Kosovo and the EU over a transitional period of up to 10 years. Many custom duties were eliminated immediately upon the SAA’s entry into forcelegalpoliticalstudies.org, and by 2025 the vast majority of Kosovo-origin goods enter EU markets at 0% tariff, with only a few sensitive agricultural products subject to quotas or remaining duties. The SAA also commits both sides to eventually allow free movement of services, rights of establishment, and investment – integrating Kosovo’s economy more closely with the EU

Goods: For goods produced in Kosovo, these agreements unlock a combined market of hundreds of millions of consumers without customs barriers. In practice, a Kosovo manufacturer can export its products duty-free to all CEFTA countries and to the entire EU (as well as to other partners like Turkey or the UK under separate deals), so long as those goods qualify as Kosovo-origin under the agreements’ rules. This dramatically lowers the cost of Kosovo exports, making them more competitive. For foreign investors, it means that setting up a factory in Kosovo can provide tariff-free access to the EU market (over 450 million consumers) and the neighboring Balkans (another ~20 million people). For example, a Kosovo-based furniture producer can import raw materials, add value locally, and then export finished furniture to Germany or Albania without paying import tariffs, provided it meets the origin criteria – a major incentive for investment in production.

Services: While goods trade has led the way, services are increasingly covered by these regimes as well. CEFTA members have negotiated Additional Protocol 6 on Trade in Services (AP6) to remove key barriers to services trade in the regionpa.eu. This means a Kosovo IT or consulting company, for instance, can more easily provide services in neighboring CEFTA markets with fewer licensing hurdles or discrimination. Likewise, the SAA includes provisions for Kosovo businesses to supply services in EU countries. Over time, Kosovo firms will be able to establish branches in EU states and offer services under the same conditions as local companies, and vice versa. The SAA explicitly calls for gradually liberalizing the supply of services and ensuring Kosovo companies can operate in the EU’s single market for services under certain conditions. In short, Kosovo’s lawyers, IT developers, architects, and other service providers are gaining expanded regional and European access, complementing the tariff perks that manufacturers enjoy.

Example: A Kosovo-based tech startup can serve clients across Southeast Europe thanks to CEFTA’s service liberalization. At the same time, a Kosovo wine producer can export wines duty-free to the EU under the SAA, as long as it meets the origin rules. These opportunities showcase how both goods and services from Kosovo are increasingly welcome beyond its borders – a compelling pitch for investors looking to base operations in Kosovo.

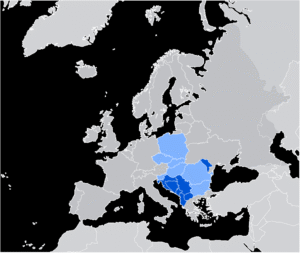

Kosovo and its CEFTA partner countries are highlighted in dark blue on the map (former CEFTA members now in the EU are shown in light blue). These preferential trade ties enable Kosovo exporters to reach regional markets tariff-free.

Despite occasional non-tariff barriers and political disputes in the region, the overall trend is toward deeper integration. Businesses sometimes face challenges (e.g. bureaucratic delays or recognition of certificates), and indeed Kosovo’s exports to certain neighbors have been disrupted in the past by political disagreements. Encouragingly, as of 2024–2025 those frictions are easing: Kosovo lifted a ban on Serbian goods and now works within CEFTA to eliminate remaining barriers and improve dispute resolution. CEFTA parties are even developing a new dispute settlement mechanism (Additional Protocol 7) to handle trade grievances more effectively. All of this bodes well for a more unified Western Balkans market, reinforcing the value of CEFTA for any company operating in Kosovo.

Tariff-Free Access Requires Rules of Origin and EUR.1 Certificates

Preferential trade agreements are a huge advantage – but they are not automatic. To actually benefit from zero tariffs, a Kosovo exporter must prove that its product meets the rules of origin under CEFTA, the SAA, or other applicable agreements. In simple terms, rules of origin determine whether a product is sufficiently “made in Kosovo” (or another partner country) to qualify for preferential treatment. These rules exist to prevent transshipment (e.g., a third-country product can’t just be shipped through Kosovo to avoid duties; it must undergo real processing or have significant local content).

Pan-Euro-Med Rules (Cumulation): The good news is that Kosovo, like other CEFTA and Western Balkan economies, applies the Pan-European-Mediterranean (PEM) system of preferential origin rules . This system is quite flexible and investor-friendly. It allows diagonal cumulation of origin among a wide network of countries – including the EU, EFTA states (e.g. Switzerland, Norway), Turkey, and all Western Balkans. For example, if a Kosovo textile manufacturer imports fabric from Turkey (a PEM country) and then stitches clothing in Kosovo, the finished garments can still be considered Kosovo-origin under PEM rules (because the materials come from within the cumulation zone). The same goes for parts from an EU country or a CEFTA neighbor: inputs can be combined across these countries without losing the preferential origin, as long as the final product meets the specific processing requirements. This pan-Euro-Med cumulation greatly expands sourcing options for Kosovo producers while retaining duty-free eligibility into the EU market.

Each trade agreement has an attached Protocol on Rules of Origin (for instance, Protocol III of the Kosovo–EU SAA) which spells out the exact criteria. Typically, there are thresholds like a maximum percentage of non-local content or lists of processing steps that confer origin. Navigating these technical criteria can be complex, but that’s where expert guidance pays off. Rule & Law’s trade lawyers regularly help exporters determine if their products qualify and how to optimize their supply chain to meet origin rules. We ensure that companies can confidently certify their goods as Kosovo-origin and seize the available duty savings.

The EUR.1 Movement Certificate: The primary document used to prove origin to customs authorities is the EUR.1 certificate. An EUR.1 (often just called “EUR.1 form” or “movement certificate”) is an official certificate of origin used in EU, CEFTA, and other free trade agreements within the pan-European system. In practice, when you export a shipment from Kosovo to an EU country or a CEFTA partner, you would apply to Kosovo Customs for an EUR.1 certificate for that shipment. Kosovo Customs will review evidence of the product’s origin (e.g. supplier declarations, production records) and then issue a stamped EUR.1 document to accompany the goods. The importer presents this EUR.1 to their customs, which grants the preferential tariff (0% duty) on that shipment. Without this proof, the goods would be charged the normal tariff, so obtaining the EUR.1 is crucial.

Some key points about EUR.1 certificates and proof of origin in Kosovo’s context:

Issuance: Exporters must submit a written application along with supporting documents to Kosovo Customs to get an EUR.1 certificate. The Customs authorities verify that the product satisfies the origin rules (often requiring that the local content or processing meets the agreement’s criteria). Once verified, Customs endorses the certificate, which travels with the shipment to prove origin to the importing country’s authorities. This process must be repeated for each export shipment unless the exporter has special authorization (see below).

Invoice Declarations: For smaller shipments or frequent exporters, there is a simplified alternative to EUR.1. If the value of originating goods in a consignment is ≤ €6,000, any exporter can simply include an origin declaration text on the commercial invoice instead of obtaining an EUR.1. This saves time and paperwork for low-value shipments. Moreover, if a company obtains the status of Approved Exporter (also called Authorized Exporter), it can self-declare origin on invoices for shipments of any value, bypassing the need for a customs-issued EUR.1 each time. In other words, an Approved Exporter in Kosovo can ship goods and just print the origin statement on its invoice (along with its customs authorization number) to claim preferences abroad – a valuable privilege for high-volume traders.

EUR.1 Validity and Alternatives: Typically, an EUR.1 certificate is valid for up to 4–10 months and must be presented during customs clearance to get the tariff exemption. If an EUR.1 wasn’t issued at the time of export (due to an oversight), it’s often possible to get one retrospectively and still claim the preference within a certain period. Additionally, some agreements now use electronic origin documents or the REX system (Registered Exporter) for self-certification in certain cases. Kosovo Customs, for instance, implemented the REX system for exports to countries like Switzerland and Norway under GSP preferences. The trend is toward simplifying origin documentation, but as of 2025, EUR.1 and invoice declarations remain the standard proof of origin for Kosovo’s trade agreements.

Understanding and complying with these origin procedures is a necessary part of doing preferential trade. Rule & Law has deep experience in securing EUR.1 certificates for our clients and obtaining Approved Exporter status from Kosovo Customs when applicable. By ensuring your paperwork is correct and your products meet origin criteria, we help you avoid costly duty payments and enjoy seamless access to CEFTA, EU, and other markets.

Kosovo’s Legal Framework for Export Certification and Origin Compliance

Kosovo has built a domestic legal framework that aligns with these international trade agreements and facilitates exporters’ access to preferences. The foundation is Kosovo’s Customs and Excise Code (and its implementing regulations), which includes provisions on determining origin and issuing certificates. In fact, Articles 23–28 of the Customs Code and associated administrative instructions set out how origin is conferred and proven. Preferential origin, in particular, is granted according to the criteria of the trade agreements that Kosovo is part of, and the government has adopted the Regional Convention on Pan-Euro-Mediterranean rules of origin into its national regulations. This means Kosovo’s law mirrors the PEM Convention rules – providing consistency for businesses.

Key elements of the current legal framework include:

Designation of Authorities: Kosovo Customs is the competent authority for issuing certificates of origin (EUR.1) and for granting the status of Approved Exporter. Exporters must apply to Customs for these, and Customs in turn verifies compliance. (Note: Non-preferential certificates of origin, used for commercial purposes outside FTAs, can be obtained via chambers of commerce, but those do not grant duty benefits.)

Approved Exporter Status: Kosovo Customs has established procedures (through an internal instruction in 2017) to authorize exporters who frequently ship originating goods to SAA/CEFTA markets to self-certify their origin. To qualify, an exporter typically needs a record of compliance and sufficient internal controls. Once approved, the Customs Director issues an authorization number to the company, which can be quoted on all invoices containing origin declarations. This Approved Exporter status is valid for all exports to countries with which Kosovo has preferential trade agreements. It’s a valuable streamline for regular exporters – and Rule & Law can assist in preparing the application dossier to attain this status. Our legal team guides businesses through the requirements (such as demonstrating product origin calculations and a solid compliance track record) to satisfy Customs that they are eligible for approval.

Customs Procedures for Certification: The process to obtain an EUR.1 certificate in Kosovo is outlined by customs procedure regulations. Exporters must submit the customs export declaration along with an application for the EUR.1 at the time of export. All necessary supporting documents (invoices, bills of materials, etc.) should be provided to prove origin. Kosovo Customs then issues the EUR.1, typically on the same day as the export clearance. In cases where an error or omission occurred, the law allows for issuing the certificate after exportation (a posteriori), so exporters aren’t completely out of luck if they forgot to do it beforehand. There are also provisions for duplicate certificates if the original is lost. Overall, Kosovo’s system is designed to be in line with European practices, so if you’re familiar with EU customs processes, Kosovo’s won’t feel foreign.

Legal References: The SAA itself was ratified in Kosovo’s law (Law No. 05/L-069) and includes Protocol III on origin. Similarly, the CEFTA 2006 Agreement (Law No. 03/L-109, as amended) and subsequent CEFTA Additional Protocols on trade facilitation and services are part of Kosovo’s legal obligationsdogana.rks-gov.net. What this means for businesses is that preferential trade is backed by domestic law – giving certainty and legal remedies if issues arise. For instance, if an exporter believes Customs improperly denied an EUR.1 certificate, there are legal avenues to appeal that decision under Kosovo’s customs law.

Kosovo’s commitment to aligning with EU trade standards is also evident in its adoption of systems like REX (for certain exports) and its membership in international conventions. The country is constantly updating its trade legislation in preparation for eventual EU accession. For investors, this translates to a predictable and EU-oriented trade environment. Your company’s export operations from Kosovo will be dealing with familiar rules and documents, minimizing the learning curve.

(For specific guidance on Kosovo’s export regulations – from registration as an exporter, to obtaining EORI numbers, to compliance with Sanitary/Phytosanitary standards – feel free to reach out to Rule & Law. Our firm stays up-to-date on all regulatory changes and can ensure your export business meets every requirement.)

Strategic Advantages of Kosovo’s Geographic and Legal Position

Beyond the formal trade regimes, Kosovo offers strategic advantages that make it an attractive hub for regional trade:

Geographic crossroads: Nestled in the Western Balkans, Kosovo sits at the intersection of Southeast European markets. It is within a day’s drive of major ports (Durres, Thessaloniki) and EU borders (Hungary, Croatia, Romania via neighbors). This proximity means short supply chains into the EU. Investors in Kosovo can easily distribute goods to Central Europe or the Mediterranean region. Moreover, Kosovo shares language and cultural ties with Albania and others, facilitating business in neighboring markets.

Unified Currency: Kosovo unilaterally uses the Euro (€) as its currency, which eliminates exchange rate risk in trading with EU partners. For an exporter, pricing and receiving payment in euros simplifies transactions with European customers. It also signals monetary stability – an added comfort for foreign businesses used to dealing in euros.

Expanding Network of Trade Agreements: In addition to CEFTA and the EU SAA, Kosovo has free trade agreements or arrangements with other important markets. It has an FTA with Turkey (providing preferential access to Turkey’s large market) and a bilateral trade agreement with the United Kingdom (maintaining post-Brexit preferences). Notably, Kosovo has also signed a new Free Trade Agreement with EFTA (Switzerland, Norway, Iceland, Liechtenstein) in January 2025, which will come into force pending ratifications. This will open yet another duty-free corridor for Kosovo-made products. When all these are in effect, a manufacturer in Kosovo will have tariff-free (or reduced-tariff) access to the EU, the UK, the Western Balkans, Turkey, and EFTA countries – a remarkable coverage of high-value markets. For an investor, this means one production base in Kosovo can serve multiple lucrative markets under preferential terms.

Legal Harmonization and EU Alignment: Kosovo’s legal system is steadily aligning with the EU acquis communautaire (body of EU law) as part of the SAA obligations. Everything from competition law to product standards is being reformed to match EU regulations. For businesses, this means that products made in Kosovo are increasingly meeting EU standards by default – easing their entry into EU countries. It also means a more level playing field and stronger rule of law in the economic sphere. In practical terms, a foreign investor will find Kosovo’s laws on companies, contracts, customs, and intellectual property to be familiar and supportive of business, with ongoing improvements in areas like quality infrastructure and certification (often with EU technical assistance). Additionally, Kosovo is part of regional initiatives like the Common Regional Market 2025 (an extension of CEFTA cooperation) and the Western Balkans investment initiatives, which aim to remove remaining market frictions among the Balkans and with the EU.

Competitive Costs and Skills: Although not explicitly part of preferential trade agreements, it’s worth noting that Kosovo offers competitive labor costs, a young and educated workforce, and improving infrastructure. When combined with the duty exemptions on exports, these factors amplify the profitability of producing in Kosovo. For example, an auto-parts producer can benefit from low production costs in Kosovo and then export components duty-free to car assemblers in the EU – a compelling business case.

Kosovo’s location and legal ties position it as an ideal export platform. Companies operating here enjoy the double benefit of a cost-effective base and privileged access to multiple markets.

Disclaimer: The information in this post is not legal advice and may not reflect the latest changes. Please consult our Lawyers in Kosovo for your specific case.